Featured Projects

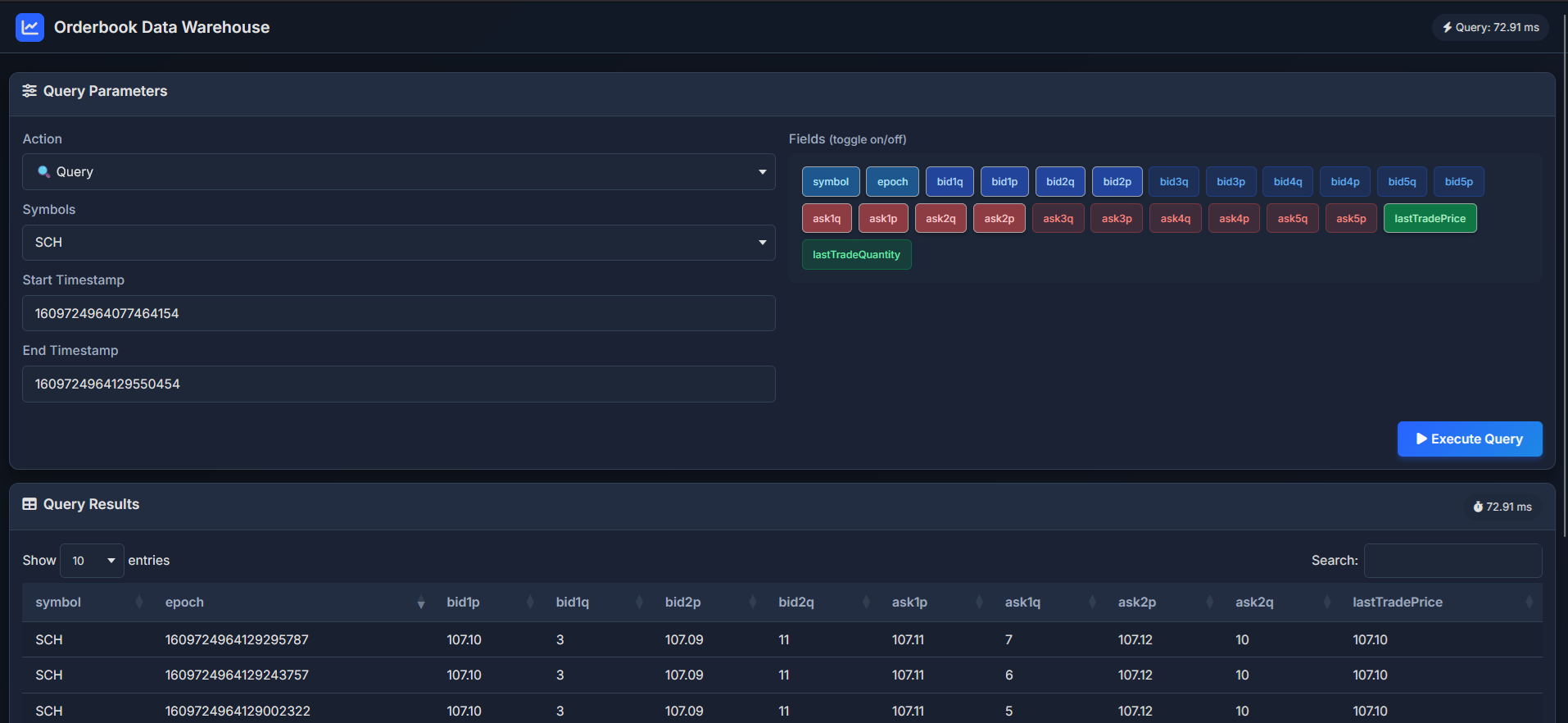

Large-Scale Time-Series Order-Book Warehouse

High-performance C++17 warehouse with fixed-size binary snapshots, multithreaded query engine, and fast random access.

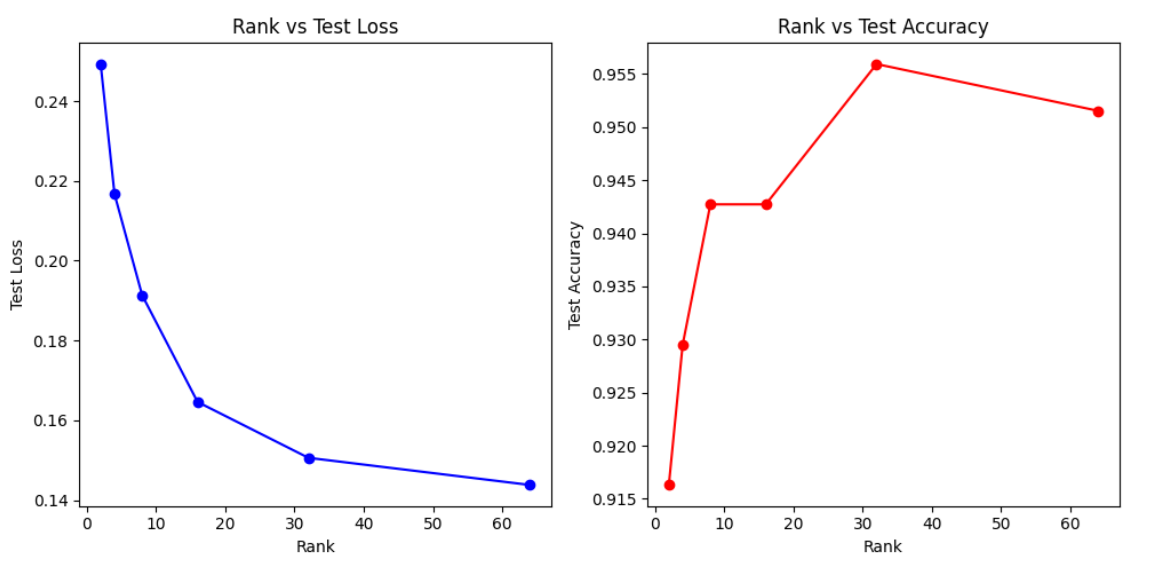

LoRA Enhanced LLM Fine-Tuning for Finance NLP

Fine-tuning pipelines with quantization-aware training and adaptive LR for sentiment and market analysis tasks.

DAO Governance Framework + ADI Token

Ethereum smart contracts for proposals, voting, and execution. ERC-20 token for secure and democratic voting.

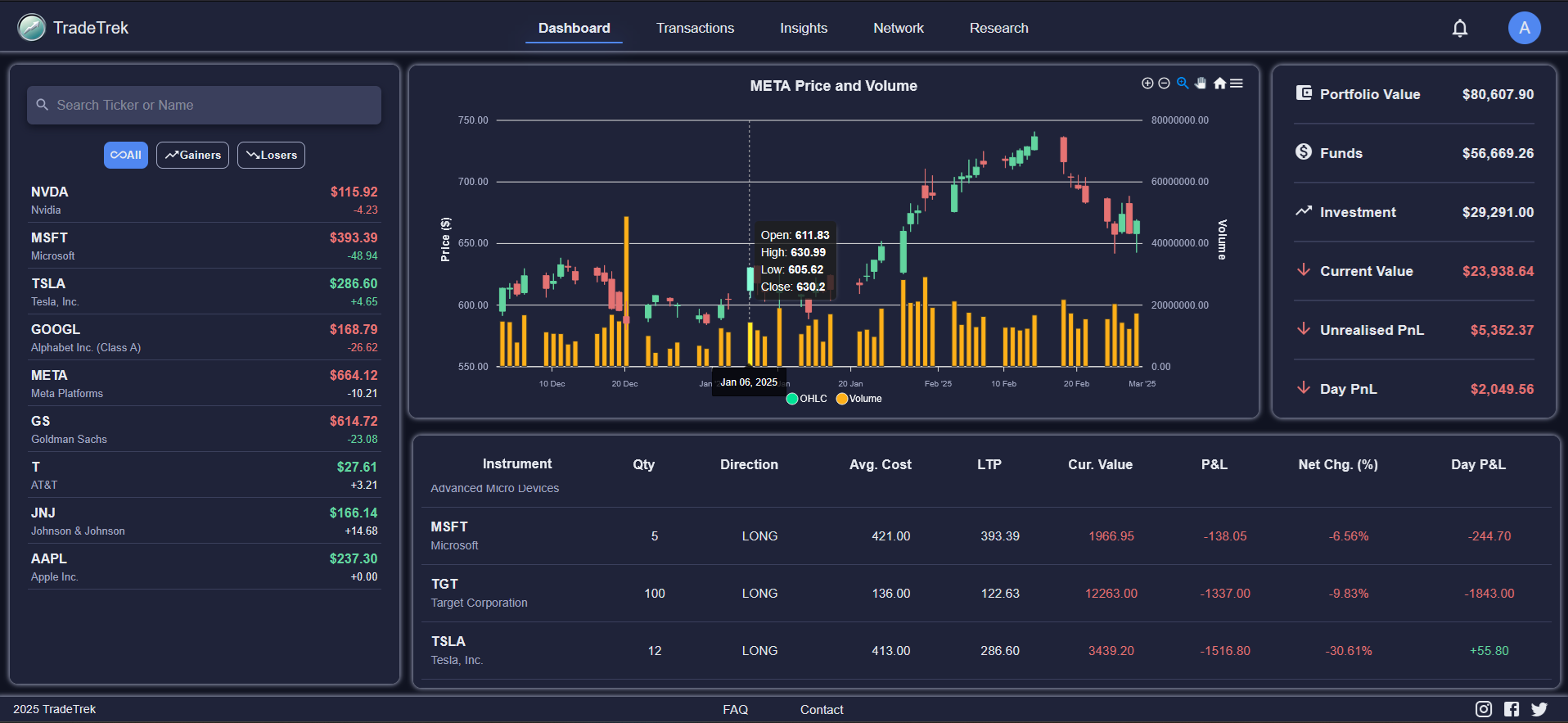

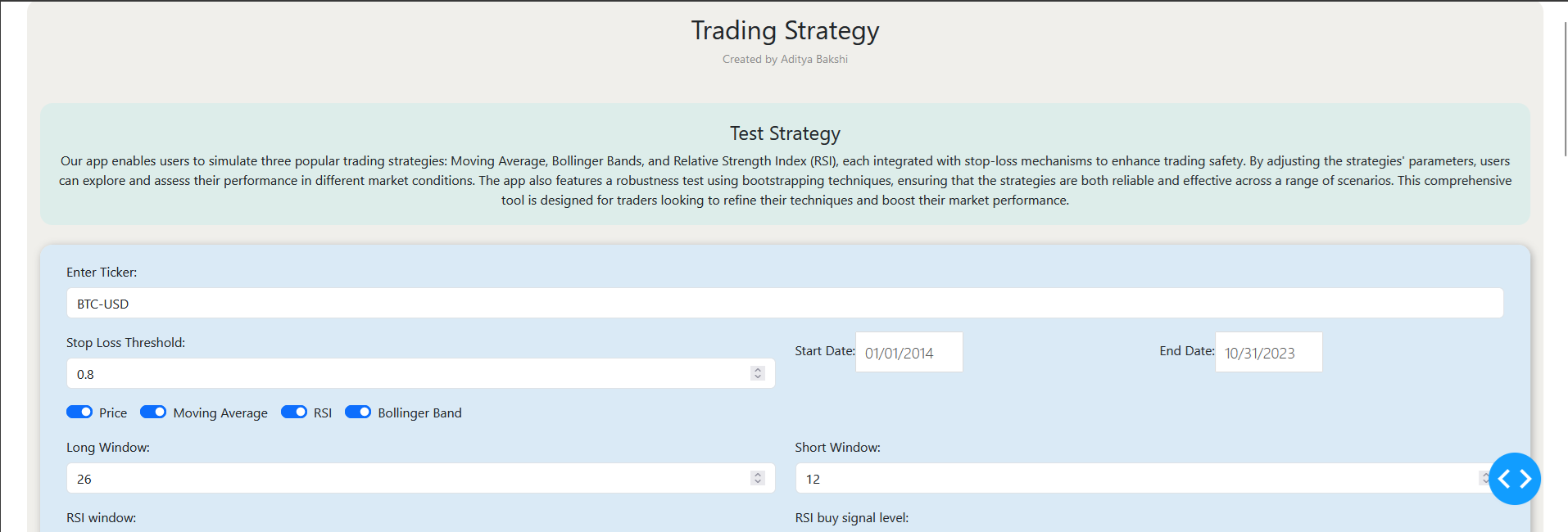

Technical Strategy Analyzer

Interactive Dash app for backtesting technical strategies with tunable parameters and result comparison.

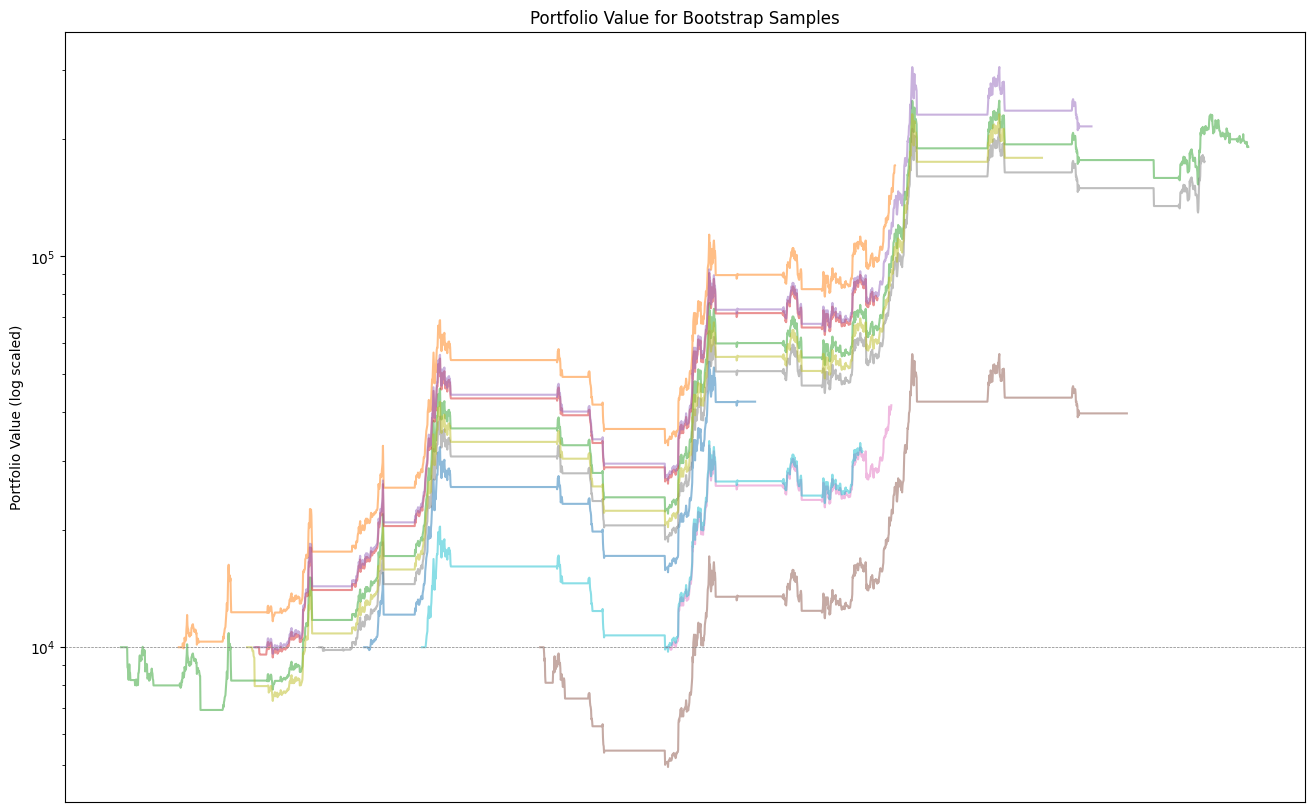

Cryptocurrency Momentum Algorithmic Trader

Momentum-based BTC strategy with robust backtesting and bootstrapping analysis.

Latest on GitHub

Recent repositories & updates (pulled live).

Experience

-

MassMutual

2025–Present-

Investment Quantitative Developer 2025–Present

Designed statistical models & data pipelines supporting a $285B investment account across FI ETFs, structured credit, and derivatives. Built front-office tools and integrated Python, Docker, and GitHub workflows.

-

-

Endless Frontier Labs

2024–2025-

Research Analyst 2024–2025

Built scalable Python/SQL data pipelines and the organization website with interactive analytics.

-

-

Estee Advisors

2020–2023-

Quantitative Researcher 2023

Built long-only multi-factor models for Asian equities; applied ML to macro/technical/alt data; achieved >1% monthly alpha with high Sharpe and low volatility.

-

Senior Software Engineer — Trading Middleware 2021–2023

Real-time risk engine with sub-millisecond recalibration; event-driven strategy builder & execution engine; HFT middleware with 5.9μs latency; led API/WebSocket integrations.

-

Software Engineer — Investment Platform 2020–2021

Engineered a scalable advisory platform “Gulaq” on FastAPI/AWS/MySQL serving 100K+ users via microservices, SQS, and serverless compute.

-

Education

-

New York University

2023–2025- Teaching Assistant: Machine Learning; NLP & Investment Process; Advanced Deep Learning.

- Focus: Computational finance, Derivatives, Time-series Analysis, Deep Learning, Optimization.

-

Netaji Subhas Institute of Technology (NSIT)

2016–2020- Coursework: Data Structures & Algorithms, Operating Systems, Databases, Probability & Stats.

Skills & Tools

Core

Systems

Specialties

Certifications

GARP FRM® Level 1

Earned elite distinction (top 5% globally).

NISM Series-XVI: Commodity Derivatives

Score: 92.7%.

Bloomberg Market Concepts

Certification.